28 Feb, 2023

PET releases full year results to December 2022

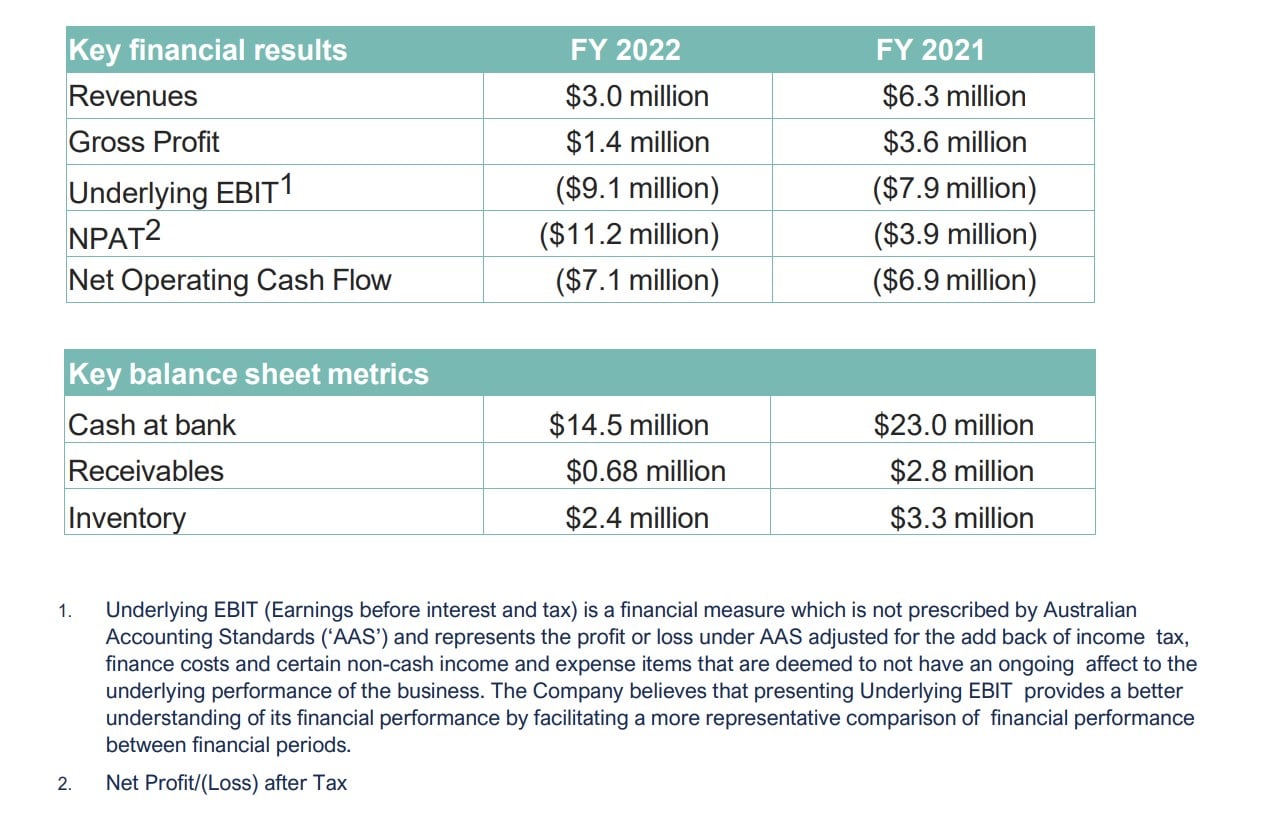

Revenue for the period was $3.0 million, down 52% on the $6.3 million generated in the prior corresponding period, which benefitted from a major project completion in Europe (Kralingse Plus Lake, in the city of Rotterdam). The business continued to face headwinds during the year, primarily as a result of project delays and the continued priority given by government authorities to managing COVID related health initiatives. The Company continues to execute on its diversification strategy,

with the majority of sales generated across South America and modest contributions in Europe, ANZ, USA and China.

FY22 revenues were generated from projects in Europe (8% of total); The Americas (85%); China (2%) and Australia/New Zealand (5%). Gross profit was $1.4 million (FY21: $3.6 million). The gross profit margin was 45% for the full year (FY21: 57%). The lower gross margin was driven by higher freight costs in the period partially offset by favourable pricing, particularly in Europe, and slightly lower project application costs.

Underlying Earnings Before Interest and Tax (EBIT) for the year was a loss of $9.1 million compared to a loss of $7.9 million in the prior corresponding period. Lower sales volumes and revenue flowing to gross margin and higher operating expenses contributed to the result. Operating expenses were higher in the reporting period, as a result of expenditure on restructuring costs in China, expenses incurred in relation to manufacturing operations (both PET’s current plant in China and scoping of a

proposed expansion facility in the US), ongoing legal and consulting expenses pertaining to the fraud and mismanagement investigations and consultancy costs relating to ongoing R&D activity, government lobbying to enable certification in Canada and the Company’s manufacturing/supply chain strategy.

Net Profit after Tax (NPAT) was a loss of $11.2 million (FY21: loss of $3.9 million). The FY 21 reporting period included non-cash adjustments to lease liabilities as a result of the Group signing a lease modification with its landlord in relation to the China factory, which reduced the lease term, square footage and overall cost and is part of the ongoing effort to right-size the business. The value of this adjustment was $3.28 million. This was not repeated in FY22.

PET’s CEO and Managing Director, Lachlan McKinnon, said while the FY 22 performance was disappointing, it did provide the opportunity to reset and restructure the business to better exploit potential opportunities after the significant challenges of the past few years.

“During 2022 we focused on a number of initiatives to strengthen the business and improve our prospects for generating revenues going forward. This includes our move to a ‘distribution-led’ go-to- market model which is expanding PET’s addressable market across smaller and more repeatable projects in each region and allows our direct sales team to focus on large and more substantial lake projects.”

During 2022, a strategic partnership was secured with SSI Services (UK) Limited, the specialist contracting division of South Staffordshire Plc, one of the UK’s largest water utilities. PET also entered into a distribution relationship with Aquatic Solutions in the UK. These partnerships ensure a national approach across the UK that is expected to deliver improved customer engagement, seamless application support and strong technical reach.

“Our existing distribution arrangements in Brazil, with HydroScience, have generated good outcomes during 2022 and we expect these to continue in 2023. Relatively new distribution agreements have been put in place in Germany, The Netherlands and Belgium with discussions underway in Ireland and Switzerland.”

“In North America, we have appointed numerous distribution partners to support this model. Sales were made through this model in the latter part of 2022. Progress was made in developing opportunities in the larger lake and water body segment.”

In 2022, PET also secured access to a new patented product, Phosflow, which has been proven to be effective in the removal of phosphorus from freshwater sources including stormwater, agricultural run-off and municipal wastewater.

“Phosflow opens-up important new opportunities for the business,” said Mr McKinnon. “As a solution to addressing flowable water remediation issues, it is highly complementary to PET’s own patented technology and addresses one of the Company’s key strategic objectives of broadening our service offerings into additional market segments. We have now achieved initial sales of Phosflow and interest in the product is steadily building.”

The PET team has been strengthened over the past year, with key appointments made to support commercial operations and other areas of the business.

“As travel restrictions eased in the post-COVID environment, it was critical that we began the process of resuming discussions on projects that had been paused over recent years and initiated discussions on potential new projects. We now have the resources and programs in place to effectively promote the benefits and value of Phoslock remediation technologies and services.

‘In 2023, our clear priority is to execute on our sales strategy by securing multiple projects across different regions and in different market segments. There is an inevitable time lag in converting leads to pilot applications and contracted sales, hence the Company is budgeting to incur a loss in this current financial year FY23 and losses may potentially continue in FY24 as the business continues to rebuild. We have also engaged corporate advisors to explore all available options to maximize shareholder value and will keep shareholders informed as we progress this work.’

Please join PET at 9.00am on Wednesday 1 March 2023 when Lachlan McKinnon, Managing Director and Chief Executive Officer and Matthew Parker, Company Secretary and Chief Financial Officer will provide a review of the financial results for the full year ended 31 December 2022 and the Group’s activities and strategic outlook.

Click here to register for the webinar

To see the preliminary FY2022 results report Download PDF.